Student Insurance

There are 2 situations of going about the insurance claims. First method is ‘Direct Billing’ wherein the onus is on the medical provider to get the medical expenses settled with the insurance company. So, insured pays or promises to pay for the minor portion of medical bill i.e. Deductible, co-insurance or copay

after the treatment/consultation at a preferred or In-network provider and medical provider bills the insurance company for the major portion (remaining amount) of the medical bill.

Another method is wherein the insured pays the whole amount of the bill for a treatment/consultation at a non-preferred or out-of-network provider and then claims the amount due to himself from the insurance company.

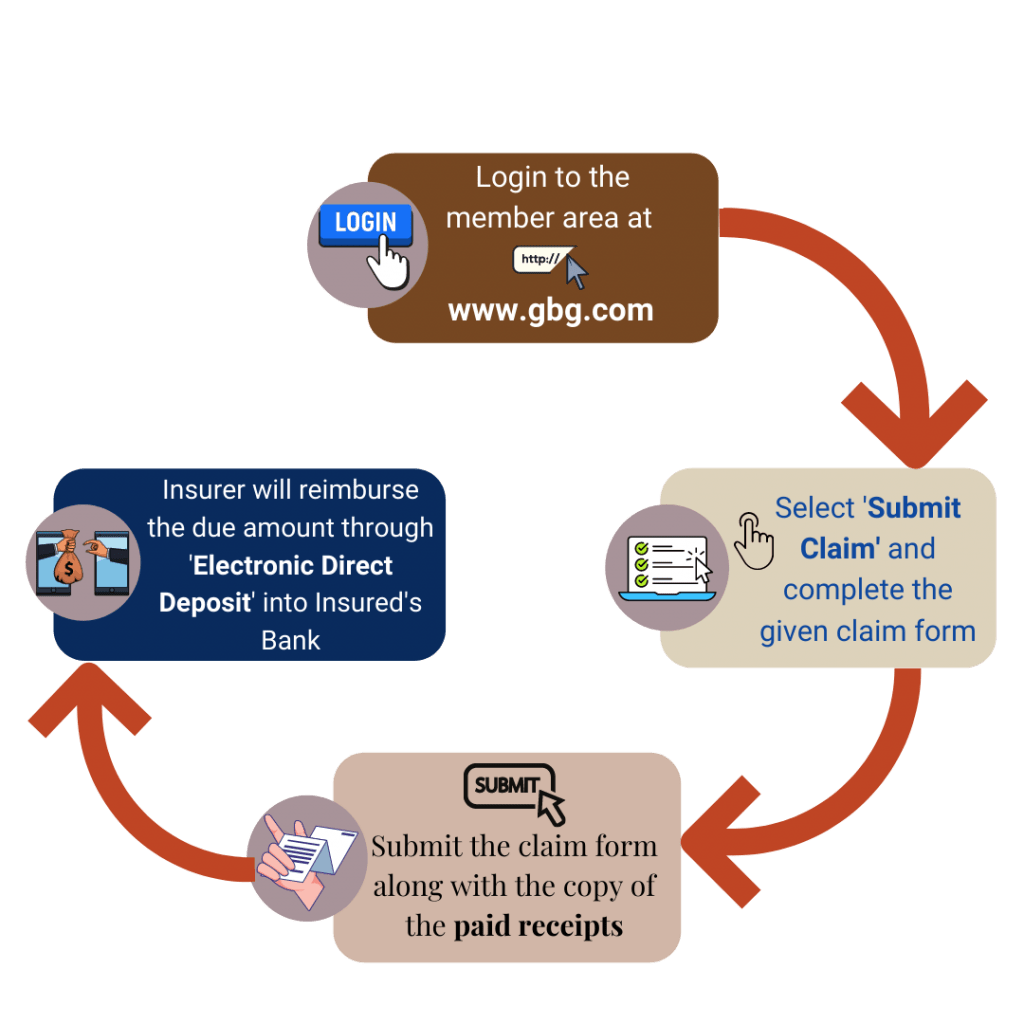

Among the 2 situations mentioned above, essentially the actual claim process is considered to be the one where the insured has to get the claim settled with the insurance company. So, when a student takes insurance plan offered by us and wants to get the medical expenses reimbursed under the insurance post the treatment/consultation, then follow the below step-by-step process:

*Other methods are also available if Insured’s bank is not located in the US or when electronic payment is not possible

As F-1 OPT plans are offered by us are provided by the different international insurance companies, so the claim process will depend upon the terms of claim procedures of that particular insurance company under which student is insured.

As a general procedure claim procedure for all international companies are more or less same as it is for the student insurance plans i.e. for F-1 students. So according to the insurance plan chosen by the student, he/she has to follow the same steps barring the particular information of the insurance company i.e. website or the claim email which is chosen by the insured.

For e.g. Terms of claim for a plan named ‘Exchange guard’ under Tokio Marine, claims have to be submitted to the insurance company for any expense paid by it. This also includes the expenses for the treatment or services for which the medical provider would directly bill the insurance company. So the claim has to be submitted by both parties to the insurance company

So, it is recommended, student connects with the respective insurance representative for the claim procedures under these plans.

Travel Insurance

In case of any expenses incurred due to circumstances or acts beyond insured’s control during your travel duration or otherwise for which benefits is provided under the travel insurance policy, follow the steps to avail such benefits:

- Inform the insurance company of the situation and apply for a due reimbursement within 30 days of the event.

- Claim application includes submission of claim form and required documents like a proof of loss of a particular covered object i.e. passport etc.

- After the due assessment and verification, amount will be reimbursed as per the policy terms and conditions.

In case of travel emergencies, check with the insurance representative how one can avail cashless treatment option.

General document list required for claim reimbursement:

- Filled claims form

- Original policy copy

- Copies of the Passport pages with ID details and immigration stamps

- Original bills and their receipts

- FIR or police report for theft or other criminal case

Motor insurance

Insurance claim process related to your car insurance policy is categorized as for 3 situations:

- When claim is related to the damages of your own car:

- As soon as a damage happens (in most cases it is accidental), intimate the insurance company. Then you may fill the claim form and other insurance documents online or at the workshop where you have taken your car for repairing. Consulting your insurance representative is the recommended way of going forward.

- The surveyor will then asses the extent of the damages to be covered under respective car insurance plan. Based on surveryor’s report you may decide whether to get the full repair done or not as per the extent of insurance coverage provided.

- Once the repair is completed, repair bill will be sent by the surveyor to the insurance company which will either treat as cashless or reimbursement form of claim.

- Accordingly, you pay your share of the expense (sometimes only file charges in case of zero depreciation coverage) or the full amount if it’s a reimbursement.

- When claim is related to stolen of insured’s car:

- After the incident lodge and submit the copy of the FIR to the insurance company

- Insurance company will assign an investigation after a final report of non-traceability of the concerned car is submitted.

- Thereafter if the claim is approved, submit the following to the insurance company.

- RC book

- Duplicate keys and

- Subrogation letter

- Notarized indemnity

- Claim will be disbursed, post all the above formalities.

- When the claim is related to the damages to third parties i.e. other cars:

-

- In case you insured has been accused or notified of any damages made by him to a third party i.e. other’s car or any other property, inform the insurance company immediately before taking any minor decision or step.

- Submit the notification, RC, DL and the related FIR.

- After due verification, insured will be assigned a lawyer for the same

- If according to legal order, damages has to be paid by the insured then insurance company directly pays the due amount to the third party.

Mediclaim / General Health insurance

There are two ways through which benefits can be availed under Mediclaim and health insurance plan:

Cashless benefit: In case of a planned hospitalization at any network hospital or medical facility for any of the insured under the policy, the insurance company has to be informed through a pre-authorization form.

In case of an emergency hospitalization, the intimation has to be done within 24 hours.

Post-intimation, Insurance ID card is to be shown to the concerned Insurance desk of the medical facility. With the help of the same and the guidance by the insurance representative, a cashless claim request along with the required documents will be submitted and assessed by the insurance company. Accordingly a partial or a full benefit will be informed to concerned hospital department.

Reimbursement benefit:

If all the above steps are not taken in the proper way or timeline for e.g. if the medical facility is not under the network or treatment was not intimated within 24 hours of hospitalization then the insured can file a reimbursement claim after the medical treatment. Following are the documents required to be submitted through email or online:

- Duly filled Claim form

- Cancelled cheque copy

- Discharge summary (with details of complaints and the treatment availed)

- Final Hospital Bill (Cost-wise break-up) along with interim bills

- Payment Receipts

- Doctor’s consultation papers

- All investigation reports (E.g. Original Blood report, X-ray, Sonography, CT Scan, MRI, etc.)

- All pharmacy bills supported by doctor prescriptions

- Implant sticker / invoice, if used (E.g. lens details in cataract case, stent details in angioplasty)

- Medico Legal Certificate (MLC) and / or FIR for all accident cases

- Any other related documents

*Please note: All documents should be in Original. This is not an exhaustive list; any other document could be required post assessment of your case.

After the documents are submitted, you keep a track of the claim status and follow the instructions given by the insurance so as to conclude the claim reimbursement application.